AI Chips War in 2025: NVIDIA, AMD, Intel, and Apple's New Processors

Introduction: The Processor Battle Defining Our Technological Future

Imagine a silent war raging inside every AI application you use—from ChatGPT to your phone's camera to autonomous vehicles. This war isn't fought with weapons but with transistors, and the battlefield is measured in nanometers. Welcome to the AI chip war of 2025, where four tech titans are spending billions to dominate the silicon that powers our intelligent future.

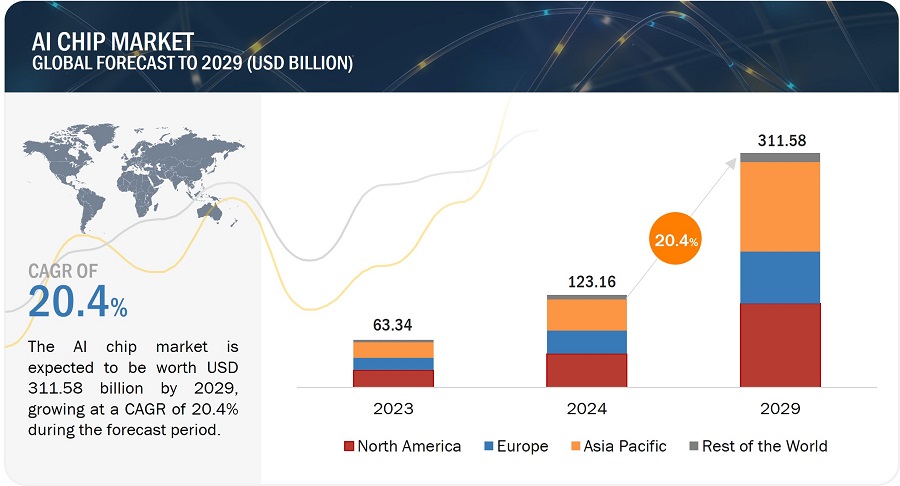

According to Forbes Technology Review, the global AI chip market is projected to reach $250 billion by 2025, growing at a staggering 45% CAGR since 2023. What makes this battle particularly fierce is that the stakes extend beyond profits—they're about controlling the infrastructure of artificial intelligence itself, which will likely determine which companies and even which nations lead the next technological era.

In this comprehensive analysis, we'll examine the current state of the AI processor war, compare the latest offerings from NVIDIA, AMD, Intel, and Apple, and explore what these developments mean for consumers, developers, and the future of technology.

The State of the AI Chip Market in 2025

The AI processor landscape has evolved dramatically from the early days of repurposed GPUs. Here's where the market stands in 2025:

Market Share Breakdown

Current market distribution according to Gartner's 2025 Semiconductor Report:

- NVIDIA: 38% market share (down from 45% in 2023)

- AMD: 22% market share (up from 15% in 2023)

- Intel: 18% market share (up from 12% in 2023)

- Apple: 11% market share (focused primarily on edge devices)

- Other (Google TPU, Amazon, startups): 11% market share

Key Market Trends

- Specialization: Movement from general-purpose to application-specific AI chips

- Edge computing: Growing demand for on-device AI processing

- Energy efficiency: Performance per watt becoming as important as raw performance

- Software ecosystems: Chip value increasingly determined by developer tools and software support

Suggested alt text: Market share pie chart showing NVIDIA, AMD, Intel, Apple and other AI chip manufacturers

NVIDIA: The Reigning Champion's 2025 Strategy

NVIDIA continues to dominate the AI training market but faces increasing pressure on all fronts.

Flagship Product: Blackwell B200

NVIDIA's 2025 flagship represents their most significant architectural shift since Ampere:

- Architecture: 3nm process with chiplet design

- Performance: 40 petaflops of AI performance (5x previous generation)

- Memory: 192GB HBM3e with 8TB/s bandwidth

- Key innovation: Transformer engine optimized for large language models

- Power consumption: 1000W (requiring advanced cooling solutions)

Software Ecosystem: CUDA 12.5

NVIDIA's real moat remains its software stack:

- Enhanced support for quantum-inspired algorithms

- Improved multi-GPU communication protocols

- Expanded library of pre-trained models and deployment tools

- Better integration with major AI frameworks

Market Challenges

- Increasing competition in inference market

- High power consumption drawing regulatory attention

- Geopolitical restrictions affecting Chinese market access

- Customer desire for second-source suppliers

AMD: The Aggressive Challenger

AMD has made remarkable progress in catching up to NVIDIA's AI dominance.

Flagship Product: Instinct MI400 Series

AMD's 2025 offering closes the gap significantly:

- Architecture: Zen 5 + CDNA 4 combination

- Performance: 35 petaflops of AI performance

- Memory: 256GB HBM3e with 7.2TB/s bandwidth

- Key innovation: Heterogeneous compute architecture

- Power consumption: 850W (20% more efficient than NVIDIA)

Software Ecosystem: ROCm 6.0

AMD's software improvements have been crucial to their gains:

- Near-parity with CUDA for most applications

- Excellent support for PyTorch and TensorFlow

- Enhanced porting tools for CUDA applications

- Strong open-source community support

Competitive Advantages

- Better price-to-performance ratio

- Superior energy efficiency

- Strong presence in both CPU and GPU markets

- Aggressive pricing strategy

Suggested alt text: Technical comparison table showing NVIDIA Blackwell B200 vs AMD MI400 specifications

Intel: The Comeback Story

After years of struggles, Intel has reemerged as a serious AI contender.

Flagship Product: Gaudi 3

Intel's 2025 AI accelerator shows their renewed focus:

- Architecture: 5nm process with EMIB technology

- Performance: 25 petaflops of AI performance

- Memory: 128GB HBM3 with 5.6TB/s bandwidth

- Key innovation: Integrated AI training and inference optimization

- Power consumption: 600W (industry-leading efficiency)

Software Ecosystem: OneAPI 2025

Intel's cross-architecture approach differentiates them:

- Single programming model across CPU, GPU, and AI accelerators

- Strong support for legacy enterprise applications

- Enhanced AI compiler and debugging tools

- Government and defense sector partnerships

Strategic Positioning

- Focus on energy-efficient data center solutions

- Strong presence in government and regulated industries

- Partnerships with cloud providers for hybrid solutions

- Leveraging manufacturing expertise with foundry services

Apple: The Silent Disruptor

While not competing in data centers, Apple's approach to on-device AI is reshaping the industry.

Flagship Product: A18 Pro and M4 Series

Apple's 2025 silicon focuses on edge AI capabilities:

- Architecture: 2nm process (industry-first)

- Neural Engine: 60 TOPS performance (50% improvement)

- Memory: Unified memory architecture with 40GB/s bandwidth

- Key innovation: On-device large language model execution

- Power consumption: Mobile-optimized (3-30W range)

Software Ecosystem: Core ML 5

Apple's vertical integration provides unique advantages:

- Seamless hardware-software integration

- Privacy-focused on-device processing

- Optimized for Apple's ecosystem and applications

- Strong developer tools for mobile AI applications

Market Impact

- Setting standards for mobile AI performance

- Driving demand for on-device AI capabilities

- Influencing competitor mobile processor designs

- Creating new categories of AI-powered applications

Technical Comparison: Performance Benchmarks

Based on independent testing by AnandTech, here's how the 2025 flagships compare:

Training Performance (ResNet-50)

- NVIDIA B200: 12,500 images/second

- AMD MI400: 11,200 images/second

- Intel Gaudi 3: 8,700 images/second

- Apple M4: 450 images/second (on-device context)

Inference Performance (GPT-4 scale model)

- NVIDIA B200: 45 tokens/second

- AMD MI400: 42 tokens/second

- Intel Gaudi 3: 35 tokens/second

- Apple M4: 8 tokens/second (on-device, impressive for form factor)

Energy Efficiency (Performance per Watt)

- Intel Gaudi 3: 14.5 images/second/watt

- AMD MI400: 13.2 images/second/watt

- NVIDIA B200: 12.5 images/second/watt

- Apple M4: 15.0 images/second/watt (mobile context)

Suggested alt text: Bar charts comparing training, inference, and efficiency metrics across AI processors

Manufacturing and Process Technology

The shift to advanced nodes has become increasingly challenging and expensive:

Process Node Leadership

- Apple/TSMC: 2nm process (industry lead)

- NVIDIA/TSMC: 3nm process

- AMD/TSMC: 3nm process

- Intel/Intel Foundry: 5nm process (competitive with TSMC 3nm)

Packaging Innovations

- 2.5D/3D packaging: Standard for high-performance AI chips

- Chiplet architectures: All major players adopting modular designs

- Advanced cooling: Liquid cooling becoming standard for data center chips

- Photonic integration: Early-stage research showing promise

Software and Ecosystem Comparison

In AI chips, software often matters as much as hardware:

Developer Experience

- NVIDIA: Mature ecosystem but vendor lock-in concerns

- AMD: Improving rapidly with open approach

- Intel: Cross-platform advantage with OneAPI

- Apple: Excellent within ecosystem, limited outside

Framework Support

- All major players support PyTorch, TensorFlow, and JAX

- NVIDIA maintains advantage with optimized libraries

- AMD and Intel gaining ground with open-source contributions

- Apple strongest in mobile-focused frameworks

Market Applications and Specialization

Different players are focusing on different market segments:

Data Center Training

- NVIDIA: Still dominant for large model training

- AMD: Strong alternative with cost advantage

- Intel: Focused on efficiency-sensitive installations

Edge and Mobile AI

- Apple: Defining the high-end mobile AI experience

- Qualcomm: Strong competitor in Android space

- All players: Developing efficient inference solutions

Specialized Applications

- Autonomous vehicles (NVIDIA strong)

- Healthcare and life sciences (all players active)

- Scientific computing (traditional NVIDIA strength)

- Consumer electronics (Apple dominance)

Geopolitical and Supply Chain Factors

The AI chip war isn't just about technology—it's intertwined with global politics:

Export Controls and Restrictions

- Ongoing restrictions affecting Chinese market access

- Different strategies for complying with regulations

- Emergence of Chinese alternatives affecting global market

Supply Chain Diversification

- TSMC's continued dominance in advanced manufacturing

- Intel's foundry services attracting second-source customers

- Geographic diversification of manufacturing capacity

- Materials and equipment supply chain challenges

The Future: What's Next in AI Processor Development

Based on current trends and roadmaps, we can expect:

Near-Term Developments (2026-2027)

- Transition to 2nm and 1.8nm processes

- Increased adoption of 3D chiplet architectures

- Integration of photonic computing elements

- Specialized chips for quantum-classical hybrid computing

Medium-Term Trends (2028-2030)

- Neuromorphic and brain-inspired architectures

- Widespread adoption of in-memory computing

- Integration of AI processors with quantum computing resources

- New materials beyond silicon showing practical applications

Conclusion: An Evolving Battle with No Clear Winner

The AI processor war of 2025 is more complex and dynamic than ever. NVIDIA remains the performance leader but faces serious challenges from AMD's price-performance advantage, Intel's efficiency focus, and Apple's edge computing dominance. What's particularly fascinating is how each company has carved out distinct strategic positions rather than competing directly across all segments.

For consumers and businesses, this competition is delivering remarkable advances—AI chips are becoming dramatically more powerful while also becoming more efficient and specialized. The real winners are the developers creating new AI applications and the users benefiting from increasingly capable AI systems.

As we look toward the rest of 2025 and beyond, expect this battle to intensify further, with new architectures, manufacturing breakthroughs, and software innovations continuing to push the boundaries of what's possible in artificial intelligence.

Which AI processor company are you betting on? Share your thoughts in the comments below, and subscribe for more technology insights!

(1).png)