Lowest Fees in Crypto: Top Exchanges for 2025

Introduction: Navigating the Crypto Trading Landscape of 2025

The cryptocurrency market, ever-evolving and dynamic, continues to capture the attention of investors worldwide. As we step into 2025, the landscape has matured significantly, characterized by increased institutional adoption, clearer regulatory frameworks, and a heightened focus on user experience and, crucially, cost-effectiveness. For both seasoned traders and newcomers, transaction fees can be a silent killer of profits. In a market where every basis point counts, choosing a crypto exchange with the lowest fees is not just a preference but a strategic imperative.

In 2025, the proliferation of exchanges means more choices, but also more complexity in identifying platforms that genuinely offer competitive rates without compromising on security, liquidity, or features. The days of simply picking the most popular exchange are waning; savvy investors are now performing thorough due diligence, understanding fee structures, and leveraging every advantage to optimize their portfolios. This guide aims to cut through the noise, providing a comprehensive, updated analysis of the top crypto exchanges that stand out for their low-fee models, robust services, and suitability for various trading styles in the current year. Whether you're a high-frequency trader or a long-term HODLer, minimizing transaction costs can significantly impact your bottom line. According to a Statista report, transaction fees remain a primary revenue driver for many exchanges, highlighting the consistent need for users to be vigilant.

Understanding Crypto Exchange Fees: A 2025 Perspective

Before diving into specific exchanges, it's essential to understand the various types of fees you might encounter. In 2025, while some fee models have become standardized, others continue to innovate or differentiate. Knowing what you're paying for is the first step towards minimizing costs.

Types of Fees to Watch Out For:

- Trading Fees (Maker/Taker Fees): These are the most common fees, charged when you execute a trade.

- Maker Fees: Paid when you "make" the market by placing a limit order that isn't immediately matched. You add liquidity to the order book.

- Taker Fees: Paid when you "take" liquidity from the order book by placing a market order or a limit order that is immediately matched.

- Deposit Fees: Charges for funding your account. While many exchanges offer free crypto deposits, fiat deposits (e.g., via bank transfer, credit card) often incur charges. Banks, too, might add their own fees.

- Withdrawal Fees: Charged when you move crypto or fiat out of the exchange to an external wallet or bank account. These can vary significantly by cryptocurrency and exchange.

- Spread Fees: The difference between the buy and sell price of an asset, often seen on simpler "instant buy/sell" platforms. While not an explicit fee, a wide spread can effectively cost you more than a direct trading fee.

- Inactive Account Fees: Some exchanges may charge a fee if your account remains dormant for an extended period.

- Margin Trading/Lending Fees: Specific fees associated with advanced trading strategies, including interest rates for borrowed funds.

In 2025, transparency around fees is paramount. Reputable exchanges clearly list their fee schedules on their websites. Always check these pages carefully before committing to a platform. For example, some exchanges might offer zero-fee spot trading for certain pairs but make up for it in derivatives or withdrawal fees.

The Contenders: Top Crypto Exchanges with Low Fees in 2025

Based on their 2025 fee structures, user reviews, and overall service offerings, here are the exchanges making waves for their affordability and reliability:

1. Binance: A Low-Cost Giant with Global Reach

Binance continues to dominate the global crypto exchange scene, and a significant part of its appeal lies in its competitive fee structure. In 2025, Binance remains a go-to for many due to its tiered fee system that rewards higher trading volumes and BNB token holders.

Fee Structure:

- Spot Trading: Base maker/taker fees often start around 0.10%.

- BNB Discounts: Holding and using BNB for fees can reduce trading costs by up to 25%, a feature that has stood the test of time.

- Tiered System: Fees decrease substantially as your 30-day trading volume increases. High-volume traders can see fees drop to 0.02% maker / 0.04% taker or even lower.

- Deposit Fees: Generally free for crypto deposits. Fiat deposit options and associated fees vary by region and method (check Binance's official fee page for specifics).

- Withdrawal Fees: Variable by cryptocurrency; generally competitive but subject to network congestion.

Why it's a Top Pick in 2025: Binance's vast liquidity, enormous selection of cryptocurrencies, and robust ecosystem (including services like Binance Earn, Launchpad, and a strong NFT marketplace) make its low fees even more attractive. For active traders, the ability to significantly reduce fees through volume and BNB holdings is unmatched. However, users need to be aware of the varying regulatory landscape for Binance in different jurisdictions.

Example: A trader executing $100,000 in monthly volume on Binance and paying fees with BNB would pay significantly less than on many other platforms, potentially saving hundreds of dollars annually.

Alt Text: Binance trading interface showing real-time market data and charts.

2. Bybit: Aggressive Fee Reductions & Derivatives Focus

Bybit has solidified its position as a leading derivatives exchange, but in 2025, its spot trading fees are also highly competitive, making it an attractive option for a wider range of traders. Bybit often employs aggressive promotional campaigns for new users and offers very low fees for dedicated traders.

Fee Structure:

- Spot Trading: Often 0.10% for both maker and taker on standard accounts.

- VIP Program: Significantly reduces fees for higher trading volumes and larger asset holdings. For instance, VIP Level 1 can bring spot maker fees down to 0.05% and taker fees to 0.08% or lower.

- Derivatives: Highly competitive, with maker fees often at 0.01% and taker fees around 0.06% for perpetual and futures contracts, further reduced for VIPs.

- Deposit Fees: Free for cryptocurrency deposits. Fiat deposit options are expanding but may carry third-party fees.

- Withdrawal Fees: Vary by cryptocurrency, generally in line with network fees with a small service charge.

Why it's a Top Pick in 2025: Bybit is known for its robust trading engine, deep liquidity, and excellent customer support. Its low fees, especially for derivatives, make it a favorite among active traders. Their VIP program is relatively accessible, allowing a broader range of users to benefit from reduced costs. Many users laud its intuitive interface and advanced charting tools, as highlighted in numerous crypto exchange reviews.

Insight: Bybit's focus on innovative products and user experience, combined with its fee reductions, makes it a strong contender for traders looking for both advanced features and cost efficiency in 2025.

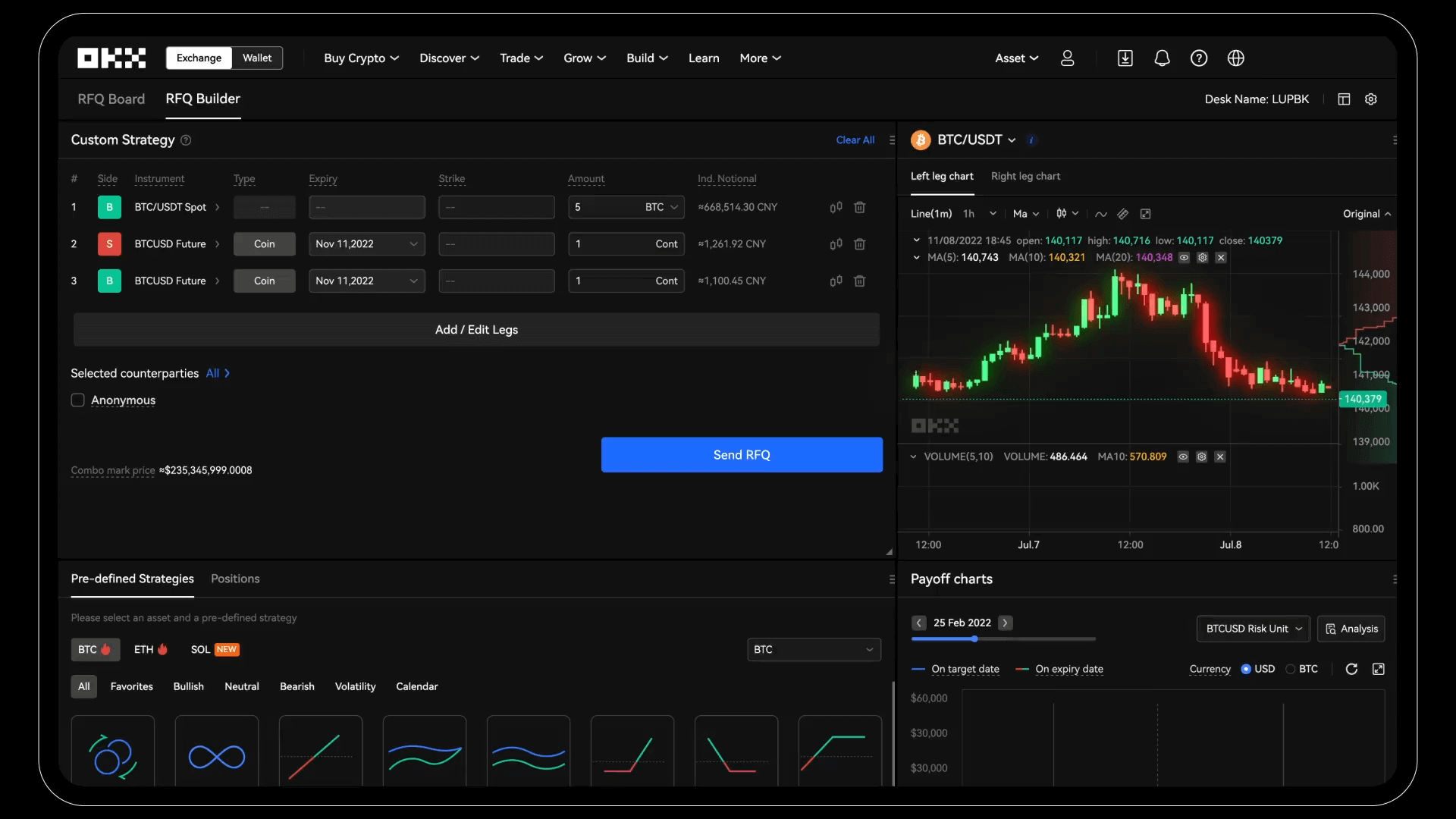

3. OKX: Comprehensive Services with Value-Driven Fees

OKX has evolved into a comprehensive crypto ecosystem offering spot, derivatives, staking, and DeFi services. In 2025, its fee model remains highly competitive, especially for users engaged across its diverse product suite.

Fee Structure:

- Spot Trading: Standard maker fees can start as low as 0.08% and taker fees at 0.10%.

- Tiered System: Fees are dramatically reduced based on your 30-day trading volume or the amount of OKB (OKX's native token) held. Top tiers can achieve maker fees as low as 0.005% and taker fees at 0.02%.

- Deposit Fees: Free for crypto deposits. Fiat deposit methods and their fees vary by region.

- Withdrawal Fees: Competitive, varying by asset; often slightly lower for OKB holders.

Why it's a Top Pick in 2025: OKX's strength lies in its extensive range of services and its commitment to providing a low-cost environment for active traders. The OKB token discount mechanism is a powerful incentive, similar to Binance's BNB. Its global presence and strong security measures also make it a reliable choice for a broad user base. As per TradingView's broker comparison, OKX often scores highly for its blend of features and fees.

Statistics: In Q1 2025, OKX reported a significant increase in user activity, partly attributed to its aggressive fee reductions and expansion into emerging markets.

4. KuCoin: The Gem Hunter's Choice with Low Fees

KuCoin has earned a reputation as the "People's Exchange," known for its early listing of promising altcoins. In 2025, it maintains an attractive fee structure, particularly with the incentives offered through its native token, KCS.

Fee Structure:

- Spot Trading: Base maker/taker fees usually start at 0.10%.

- KCS Discounts: Holding KCS and paying fees with it provides a 20% discount on trading fees.

- Tiered System: Trading volume and KCS holdings further reduce fees, allowing active traders to reach maker fees as low as 0.02% and taker fees at 0.05%.

- Deposit Fees: Mostly free for crypto deposits. Limited fiat deposit options, with varying fees.

- Withdrawal Fees: Generally competitive, but can vary; often lower than some larger exchanges for certain altcoins.

Why it's a Top Pick in 2025: KuCoin is excellent for finding newer, smaller-cap cryptocurrencies before they hit larger exchanges. Its low fees, especially with KCS discounts, make it appealing for those with diversified portfolios or strategies that involve exploring emerging assets. The KCS bonus program, where holders receive daily bonuses from exchange trading fees, adds an extra layer of value.

Alt Text: KuCoin's platform displaying various cryptocurrency pairs and trading charts.

5. Kraken: Trusted and Transparent with Volume Discounts

Kraken has long been recognized for its strong security, regulatory compliance, and a wide array of fiat funding options. In 2025, it continues to offer a competitive fee structure that rewards active traders, especially for spot trading.

Fee Structure:

- Spot Trading: Maker fees start at 0.16% and taker fees at 0.26% for new users, which are slightly higher than some competitors but decrease significantly with trading volume.

- Tiered System: Trading volume over 30 days can dramatically reduce these fees. For instance, reaching higher tiers can bring maker fees down to 0.00% and taker fees to 0.10% or even lower for very high volumes.

- OTC Desk: For institutional clients or very large trades, Kraken offers an OTC desk with tailored pricing.

- Deposit Fees: Free for many crypto and fiat deposit methods (e.g., SEPA, FedWire). Credit/debit card purchases of crypto often incur higher fees (e.g., 3.75% + €0.25).

- Withdrawal Fees: Vary by cryptocurrency and network congestion, generally transparently listed.

Why it's a Top Pick in 2025: Kraken is favored by users who prioritize security, regulatory adherence, and excellent fiat onboarding/offboarding options. While starting fees might appear higher, the volume discounts are substantial for active traders. Its "pro" trading interface offers advanced features, suitable for experienced users. Forbes highly recommends Kraken for security and low fees for larger traders in its 2025 crypto exchange reviews.

Real-world Example: A small-time investor buying $100 of Bitcoin might pay a slightly higher percentage fee on Kraken compared to Binance. However, an institutional client trading millions would likely benefit from Kraken's competitive volume-tiered pricing and robust infrastructure.

Fee Reduction Strategies for 2025: Maximize Your Savings

Even with low-fee exchanges, smart strategies can further reduce your trading costs:

- Use Limit Orders (Become a Maker): Whenever possible, place limit orders that don't execute immediately. This typically gives you a lower "maker" fee, and sometimes even a zero fee or a rebate (negative maker fee).

- Increase Trading Volume: Most exchanges offer tiered fee reductions based on your 30-day trading volume. If you trade frequently, centralizing your activity on one exchange can help you reach higher tiers faster.

- Hold and Use Exchange Native Tokens: As seen with Binance (BNB), KuCoin (KCS), and OKX (OKB), holding and/or using these tokens to pay for fees can unlock significant discounts. This strategy has proven highly effective in 2025.

- Beware of Fiat Deposit/Withdrawal Fees: Always check the costs for moving money in and out of exchanges. Bank transfers (e.g., ACH, SEPA) are often the cheapest for fiat.

- Choose the Right Withdrawal Network: When withdrawing crypto, some networks are much cheaper than others. For example, using the BSC network for USDT withdrawal is usually far cheaper than Ethereum's ERC-20 network.

- Leverage Promotions: Exchanges frequently run promotions offering temporary zero-fee trading for certain pairs or new user bonuses. Keep an eye on these opportunities.

Beyond Fees: Other Crucial Factors for Choosing an Exchange in 2025

While low fees are critical, they shouldn't be the only determining factor. In 2025, security, liquidity, and regulatory clarity are equally, if not more, important.

Security and Regulation: Non-Negotiables

- Proof of Reserves (PoR): Post-2022 events, reputable exchanges (like Kraken and Binance) frequently publish Proof of Reserves reports, demonstrating they hold user assets 1:1. Always prioritize exchanges that provide this.

- Two-Factor Authentication (2FA): Mandatory for account security.

- Insurance Funds: Some exchanges maintain insurance funds to protect users against hacks or system failures.

- Regulatory Compliance: Operating in a regulated manner gives exchanges more stability and users more protection. For example, exchanges licensed in multiple jurisdictions like the EU or various US states demonstrate commitment to oversight.

The importance of a robust security posture cannot be overstated. A low fee means nothing if your assets are compromised. A Wikipedia list of cryptocurrency exchange hacks serves as a somber reminder of these risks.

Liquidity and Trading Volume: For Efficient Execution

High liquidity ensures that your orders are filled quickly and at competitive prices. Exchanges with high trading volumes (e.g., Binance, OKX) generally offer better liquidity, which translates to less slippage and better execution for your trades. CoinMarketCap's exchange rankings often reflect liquidity metrics.

Alt Text: A digital chart showing high liquidity cryptocurrency order books.

User Experience and Asset Variety

An intuitive interface, responsive customer support, and a wide selection of cryptocurrencies to trade can significantly enhance your trading experience. Some exchanges excel in offering a broad range of altcoins (e.g., KuCoin), while others focus on major cryptocurrencies with deep liquidity.

2025 Insight: Many exchanges are integrating AI-powered customer support and personalized dashboards, further enhancing user experience.

Conclusion: Making Informed Choices in a Dynamic Market

In 2025, the cryptocurrency market offers unprecedented opportunities, but maximizing your gains requires strategic decision-making, particularly concerning operating costs. Choosing an exchange with the lowest fees is a fundamental step towards optimizing your trading P&L. However, as this guide has emphasized, a holistic approach that considers security, liquidity, and overall user experience alongside fees is paramount.

Exchanges like Binance, Bybit, OKX, KuCoin, and Kraken each present compelling low-fee propositions tailored to different trader profiles. Your ideal choice will depend on your trading volume, the types of assets you wish to trade, your comfort with native exchange tokens, and your priority for features like derivatives or fiat on/off-ramps. By understanding the intricate fee structures and employing smart trading strategies, you can significantly reduce your costs and keep more of your hard-earned profits.

The crypto world is unforgiving of complacency. Stay informed, review your trading habits, and continuously seek platforms that align with your financial goals while offering the best value. May your trades be profitable, and your fees be minimal!

(1).png)