Bitcoin Halving 2025: Expert Price Predictions and Market Impact Analysis

Introduction: The Most Anticipated Crypto Event of 2025

Imagine an event that historically reshaped entire markets, created millionaires, and sparked both euphoria and panic across global financial systems. That's Bitcoin halving—and the 2025 edition is shaping up to be the most significant yet. As we approach this quadrennial event, the entire cryptocurrency world holds its breath, wondering: will history repeat itself?

For the uninitiated, Bitcoin halving is a pre-programmed event that cuts the reward for mining new Bitcoin blocks in half. While this might sound technical, its implications ripple across investment portfolios, mining operations, and global financial markets. The 2025 halving comes at a particularly fascinating time—with Bitcoin now mainstream, institutional adoption at all-time highs, and regulatory frameworks maturing globally.

In this comprehensive guide, we'll explore what makes the 2025 halving unique, analyze expert price predictions, and help you understand the potential market impact. Whether you're a seasoned crypto investor or just curious about this phenomenon, you'll find actionable insights here.

What is Bitcoin Halving? The Fundamentals Explained

Bitcoin halving is a fundamental feature of Bitcoin's design, coded by its mysterious creator Satoshi Nakamoto. Essentially, it's an automatic reduction of mining rewards that occurs approximately every four years or after every 210,000 blocks are mined.

Here's how it works in simple terms:

- Bitcoin miners validate transactions and add them to the blockchain

- For this work, they receive Bitcoin rewards

- Originally, the reward was 50 BTC per block

- Every 210,000 blocks (roughly 4 years), this reward halves

- The process continues until all 21 million Bitcoin are mined around 2140

The 2025 halving will reduce mining rewards from 3.125 BTC to 1.5625 BTC per block. This might seem like a technical detail, but it triggers profound economic effects through basic supply and demand dynamics.

Historical Context: Lessons from Previous Halvings

To understand potential 2025 outcomes, we must examine previous halving cycles. There have been three halvings so far, each followed by significant market movements:

2012 Halving: The First Test

Pre-halving price: Approximately $12

Post-halving peak: $1,152 (November 2013)

Percentage increase: 9,500%

Key context: Bitcoin was still a niche asset with limited awareness

2016 Halving: Growing Mainstream Attention

Pre-halving price: Approximately $650

Post-halving peak: $19,783 (December 2017)

Percentage increase: 2,943%

Key context: Initial coin offering (ICO) boom accompanied Bitcoin's rise

2020 Halving: Institutional Entry

Pre-halving price: Approximately $8,700

Post-halving peak: $68,789 (November 2021)

Percentage increase: 690%

Key context: Pandemic stimulus, institutional adoption, and DeFi expansion

According to analysis from Forbes Crypto, each halving has produced diminishing percentage returns but increasing absolute dollar gains due to Bitcoin's growing market capitalization.

Suggested alt text: Bitcoin historical price chart with vertical lines marking halving events and subsequent bull markets

Why the 2025 Halving is Different: Unique Factors

The 2025 halving occurs in a fundamentally different environment than previous events. Several unique factors will influence outcomes:

Institutional Maturation

Unlike 2020 when institutional involvement was emerging, 2025 sees established frameworks including:

- Bitcoin ETFs managing over $150 billion globally

- Corporate treasury adoption becoming standard practice

- Traditional finance infrastructure fully integrated with crypto

Regulatory Clarity

By 2025, most major economies have established clear cryptocurrency regulations, reducing uncertainty that previously hampered adoption.

Technological Advancements

The Bitcoin ecosystem has evolved significantly with:

- Lightning Network handling millions of daily transactions

- Improved mining efficiency reducing environmental impact

- Enhanced security protocols and institutional-grade custody

Global Macroeconomic Conditions

Current IMF projections suggest moderate global growth with persistent inflation concerns—conditions that historically favor hard assets like Bitcoin.

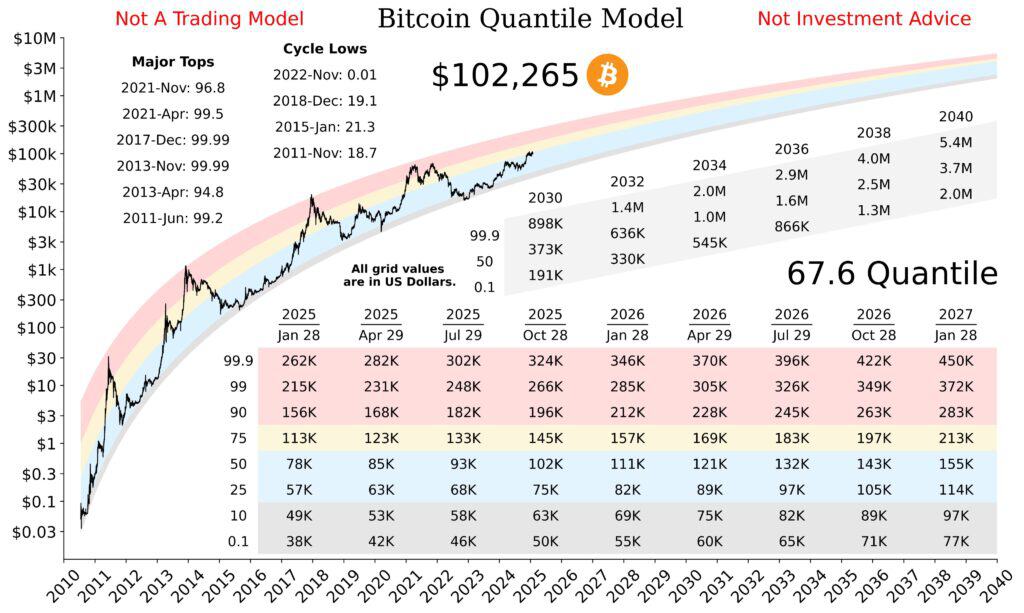

Expert Price Predictions for 2025-2026

Here's what leading analysts and institutions are predicting for Bitcoin following the 2025 halving:

Conservative Predictions ($150,000 - $250,000)

Standard Chartered Bank: Projects $200,000 by end of 2025, citing institutional flow patterns and reduced selling pressure from miners.

Bloomberg Intelligence: Predicts $180,000-$220,000 range based on historical cycle analysis and adoption metrics.

Fidelity Digital Assets: Suggests $150,000-$175,000 target, emphasizing Bitcoin's maturation as an institutional asset.

Moderate Predictions ($250,000 - $500,000)

ARK Invest: Forecasts $300,000-$500,000 based on network adoption models and institutional allocation trends.

Pantera Capital: Predicts $350,000 using stock-to-flow cross-asset comparison models.

Matrixport: Projects $250,000-$300,000 based on historical cycle analysis and current institutional inflows.

Aggressive Predictions ($500,000+)

Tim Draper: Maintains $500,000 prediction citing global adoption and Bitcoin's superiority as store of value.

Robert Kiyosaki: Predicts $1,000,000 by 2025 based on currency devaluation thesis.

Cathie Wood (ARK Invest): Long-term $1.5 million prediction but acknowledges $500,000+ possible post-2025 halving.

It's worth noting that these predictions vary widely based on methodology and assumptions. Always conduct your own research and consider risk tolerance.

Suggested alt text: Bar chart comparing conservative, moderate, and aggressive Bitcoin price predictions from various experts

Market Impact: Beyond Price Predictions

The halving's impact extends far beyond Bitcoin's price. Here's how different market segments might be affected:

Mining Industry Transformation

The 50% reduction in block rewards will significantly impact miners:

- Inefficient miners may shut down operations

- Industry consolidation likely as margins compress

- Renewable energy adoption accelerate as efficiency becomes critical

- Hash rate may temporarily drop before efficient operations expand

Altcoin and Crypto Market Effects

Historically, Bitcoin halvings have catalyzed broader crypto market rallies:

- Altcoins typically follow Bitcoin's momentum with leveraged returns

- New narratives and projects emerge during bull markets

- DeFi and NFT markets often experience renewed interest

- Overall market capitalization typically expands significantly

Institutional Response

Institutions may respond differently than retail investors:

- Increased allocation to Bitcoin as scarcity narrative strengthens

- More corporate treasury adoption following halving

- Enhanced derivatives and structured products offering

- Possible central bank responses to Bitcoin's growing influence

Potential Risks and Challenges

While optimistic scenarios abound, several risks could affect halving outcomes:

Regulatory Changes

Despite improving clarity, regulatory changes in major economies could impact adoption and price trajectories.

Macroeconomic Factors

Recession, interest rate changes, or geopolitical events could overshadow halving effects.

Technical Challenges

Network congestion, security issues, or technological problems could temporarily affect confidence.

Market Manipulation

As markets mature, sophisticated manipulation techniques could create increased volatility.

Investment Strategies for the 2025 Halving

Based on historical patterns and current market conditions, here are strategic approaches:

Dollar-Cost Averaging (DCA)

Regular investments regardless of price reduce timing risk and emotional decision-making.

Cycle-Based Allocation

Some investors increase allocation pre-halving and reduce post-peak based on historical cycle timing.

Portfolio Diversification

While Bitcoin may lead, diversifying into select altcoins and crypto projects can manage risk.

Risk Management

Establish clear entry/exit points, position sizing rules, and maximum drawdown limits.

According to Coinbase Institutional Research, investors who maintained positions through entire halving cycles historically outperformed those trying to time markets.

Suggested alt text: Comparison of dollar-cost averaging vs cycle-based investment approaches for Bitcoin halving

The Long-Term Perspective: Beyond 2025

While the 2025 halving captures attention, it's crucial to maintain long-term perspective:

Scarcity Acceleration

With each halving, Bitcoin becomes increasingly scarce relative to demand—a fundamental value driver.

Adoption Trajectory

Long-term adoption trends matter more than short-term price movements around halvings.

Technological Development

Bitcoin's ongoing development (Layer 2 solutions, privacy features, etc.) will influence long-term value more than any single event.

Global Monetary Evolution

Bitcoin's role in the global financial system will ultimately determine its long-term value proposition.

Conclusion: Navigating the 2025 Halving

The 2025 Bitcoin halving represents a significant event in the cryptocurrency calendar, but it's not a guaranteed ticket to riches. Historical patterns suggest potential for substantial gains, but many factors will influence actual outcomes.

Successful navigation requires understanding both the technical aspects of halving and the broader market context. While expert predictions range from conservative to extremely optimistic, what matters most is having a strategy aligned with your risk tolerance and investment goals.

Remember that past performance doesn't guarantee future results, and cryptocurrency investments remain volatile. The 2025 halving will likely be fascinating to watch—whether you're participating actively or observing from the sidelines.

What's your Bitcoin halving prediction? Share your thoughts in the comments below, and subscribe for more crypto market analysis!

(1).png)