Best Crypto Trading Strategies for 2025: Complete Beginner to Advanced Guide

Introduction: Navigating the 2025 Crypto Landscape

Picture this: It's 2025, and cryptocurrency has evolved from a niche interest to a mainstream financial asset class. Institutional adoption is at an all-time high, regulatory frameworks have matured, and new technologies are reshaping how we trade digital assets. Yet despite these advancements, most traders still lose money—according to recent data from CoinDesk Research, approximately 75% of retail crypto traders end up with net losses.

Why does this happen? Often because they jump into trading without a clear strategy, chasing quick profits instead of following proven methodologies. The crypto market of 2025 isn't the wild west of 2017—it requires sophisticated approaches, risk management, and an understanding of both technical and fundamental analysis.

Whether you're just starting your crypto trading journey or looking to upgrade your existing strategies, this comprehensive guide will provide actionable approaches tailored to 2025 market conditions. We'll cover everything from basic dollar-cost averaging to advanced algorithmic strategies—all with realistic expectations and proper risk management.

The 2025 Crypto Market: What's Changed and What Matters

Before diving into specific strategies, it's crucial to understand how the crypto trading landscape has evolved. Several key developments distinguish 2025 from previous years:

Institutional Dominance

In 2025, institutional players account for over 60% of daily crypto trading volume, according to Bloomberg Crypto. This means:

- Reduced manipulation compared to earlier years

- More correlation with traditional financial markets

- Increased importance of fundamental analysis

- Higher liquidity but also more efficient markets

Regulatory Clarity

Most major economies now have clear crypto regulations, reducing uncertainty but adding compliance requirements for traders.

Technological Maturation

Layer 2 solutions, improved exchanges, and advanced trading tools have made crypto trading more accessible but also more complex.

Market Correlation Patterns

Cryptocurrencies now show more predictable correlation with:

- Technology stocks (especially AI and blockchain companies)

- Monetary policy and interest rate changes

- Global macroeconomic indicators

Suggested alt text: Infographic showing crypto market structure changes from 2021 to 2025 with institutional participation growth

Essential Trading Concepts Every Crypto Trader Must Know

Before implementing any strategy, ensure you understand these fundamental concepts:

Risk Management

The foundation of all successful trading. Key principles include:

- Position sizing: Never risk more than 1-2% of your portfolio on a single trade

- Stop-loss orders: Automated orders that limit losses if trades move against you

- Risk-reward ratio: Always aim for at least 1:2 risk-reward (potential profit at least twice potential loss)

Market Analysis Types

- Technical analysis: Studying price charts and patterns

- Fundamental analysis: Evaluating project fundamentals, technology, and adoption

- Sentiment analysis: Measuring market mood through social media, news, and derivatives data

Trading Psychology

Often overlooked but critical for success:

- Emotional control (avoiding FOMO and panic selling)

- Discipline in following trading plans

- Continuous learning and adaptation

Beginner-Friendly Crypto Trading Strategies for 2025

If you're new to crypto trading, start with these lower-risk approaches:

1. Dollar-Cost Averaging (DCA)

How it works: Invest a fixed amount at regular intervals regardless of price

Example: Buying $100 of Bitcoin every Friday regardless of price

Best for: Long-term investors, beginners, those with limited time

2025 advantage: Reduces timing risk in volatile markets

Risk level: Low

2. Buy and Hold (HODL)

How it works: Purchase quality cryptocurrencies and hold for extended periods

Example: Buying Ethereum and holding for 2+ years

Best for: Patients investors believing in long-term crypto adoption

2025 advantage: Avoids short-term volatility and trading fees

Risk level: Medium (requires careful asset selection)

3. Index Fund Approach

How it works: Diversify across multiple cryptocurrencies through index products

Example: Investing in a crypto index fund or ETF that tracks top 20 cryptocurrencies

Best for: Those wanting crypto exposure without picking individual winners

2025 advantage: Several regulated crypto index products now available

Risk level: Medium

Intermediate Trading Strategies

For those with some experience looking to actively manage their portfolios:

1. Swing Trading

How it works: Capture price swings over several days to weeks

Example: Buying after a dip and selling after a 20-30% rally

Time commitment: Several hours per week

Tools needed: Basic charting platform, news sources

2025 advantage: Less time-intensive than day trading while capturing intermediate trends

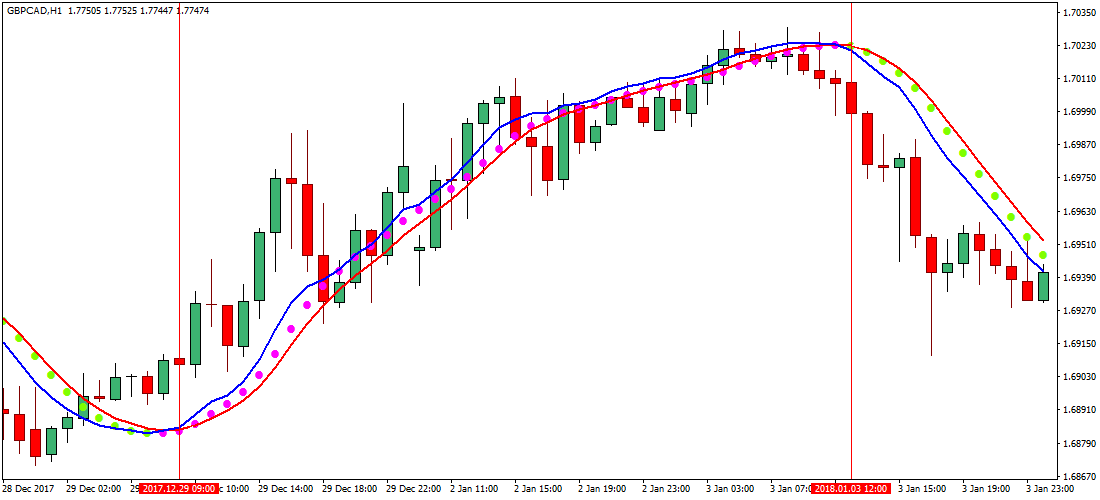

2. Momentum Trading

How it works: Follow strong trends and exit when momentum fades

Example: Buying cryptocurrencies breaking out to new highs

Indicators used: RSI, moving averages, volume analysis

2025 advantage: Crypto trends often persist due to institutional flow patterns

3. Mean Reversion Trading

How it works: Buy oversold assets and sell overbought ones

Example: Buying when RSI drops below 30 and selling above 70

Indicators used: RSI, Bollinger Bands, stochastic oscillator

2025 advantage: Works well in range-bound markets between major trends

Suggested alt text: Annotated cryptocurrency charts demonstrating swing trade entries and exits with technical indicators

Advanced Crypto Trading Strategies

For experienced traders with significant time and risk tolerance:

1. Arbitrage Trading

How it works: Exploit price differences across exchanges or markets

Types:

- Exchange arbitrage: Buying on one exchange, selling on another

- Triangular arbitrage: Exploiting price differences between three currencies

- Statistical arbitrage: Using quantitative models to identify pricing inefficiencies

2025 challenges: Increased competition and automated systems have reduced opportunities

2. Algorithmic Trading

How it works: Using automated systems to execute trades based on predefined rules

Common approaches:

- Market-making algorithms

- Trend-following algorithms

- Mean-reversion algorithms

2025 advantage: Numerous platforms now offer no-code algorithmic trading tools

3. Derivatives Trading

How it works: Trading futures, options, and other derivative products

Strategies:

- Hedging spot positions with futures

- Options strategies like covered calls or protective puts

- Volatility trading strategies

2025 advantage: Mature derivatives markets with regulated products available

Specialized 2025 Strategies

These approaches leverage unique aspects of the current market:

1. AI and Narrative Trading

How it works: Identifying and trading emerging narratives before they become mainstream

Example: Investing in AI-related cryptocurrencies before major announcements

2025 advantage: AI continues to drive significant market narratives and capital flows

2. Regulatory Arbitrage

How it works: Capitalizing on regulatory differences between jurisdictions

Example: Investing in projects likely to benefit from regulatory clarity

2025 advantage: Diverging regulatory approaches create opportunities

3. Layer 2 and Ecosystem Plays

How it works: Investing in ecosystems rather than individual tokens

Example: Identifying promising Layer 2 solutions and their native tokens

2025 advantage: Multi-chain ecosystem development creates new value opportunities

Risk Management Techniques for 2025

No strategy works without proper risk management. Key techniques include:

Position Sizing Methods

- Fixed percentage risk: Risking 1-2% of portfolio per trade

- Volatility-based sizing: Adjusting position size based on asset volatility

- Kelly Criterion: Mathematical approach to optimal position sizing

Portfolio Construction

- Diversification across uncorrelated assets

- Core-satellite approach (core holdings + tactical trades)

- Regular rebalancing to maintain target allocations

Psychological Safeguards

- Trading journals to review decisions

- Pre-defined rules for entering and exiting trades

- Regular breaks to avoid emotional trading

Suggested alt text: Flowchart showing crypto trading risk management process from position sizing to portfolio rebalancing

Essential Trading Tools for 2025

The right tools can significantly improve your trading results:

Analysis Platforms

- TradingView: Advanced charting and social features

- Glassnode: On-chain analytics and metrics

- CoinMetrics: Institutional-grade market data

Trading Platforms

- Binance: Comprehensive platform with advanced features

- Coinbase Advanced Trade: User-friendly with strong security

- Kraken: Good for derivatives and professional trading

Risk Management Tools

- Portfolio trackers like CoinGecko or CoinMarketCap

- Tax calculation software for compliance

- Automated trading bots for strategy execution

Developing Your Personal Trading Plan

A successful trading strategy requires a written plan. Your plan should include:

1. Goals and Objectives

- Realistic return expectations

- Time horizon for trading

- Capital allocation rules

2. Strategy Specifications

- Clear entry and exit criteria

- Position sizing methodology

- Risk management rules

3. Performance Review Process

- Regular strategy evaluation

- Journaling trades and outcomes

- Adaptation rules for changing market conditions

Conclusion: Building Sustainable Trading Success

The crypto markets of 2025 offer tremendous opportunities but also significant challenges. The key to success isn't finding a magical strategy but rather developing a disciplined approach that matches your skills, risk tolerance, and time availability.

Remember that even the best strategies require proper risk management, continuous learning, and emotional discipline. Markets evolve, and successful traders adapt their approaches accordingly.

Start with simpler strategies, master risk management, and gradually progress to more complex approaches as you gain experience. The most important trade you'll ever make is the trade for knowledge and discipline.

What's your favorite crypto trading strategy? Share your experiences in the comments below, and subscribe for more trading insights!

(1).png)